Today, Administration released the draft 2026 Operating and Capital Budgets. Red Deerians are invited to review the budget documents ahead of Council’s budget deliberations beginning December 8.

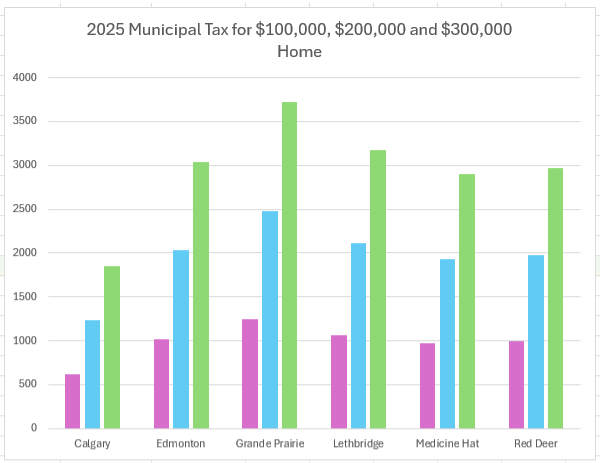

The proposed 2026 Budget continues The City’s focus on long-term financial sustainability while maintaining essential services and investing in Red Deer’s core infrastructure, systems, and people. It is a lean and responsible budget, with few new spending requests and no proposed service level reductions, reflecting Administration’s commitment to managing costs carefully while continuing to deliver the services residents rely on. Red Deer continues to maintain a competitive property tax position when compared to similar Alberta cities. See Table 1 below to see how Red Deer compares.

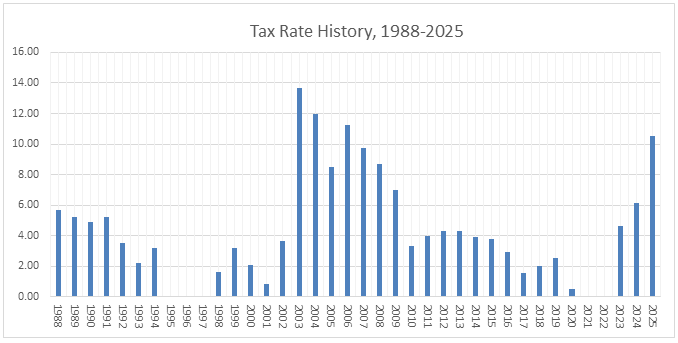

“This budget represents the next step in Red Deer’s journey toward a financially sustainable, future-focused, and community-centered city,” said Tara Lodewyk, City Manager. “Over the past several years, Council has made difficult but necessary decisions that are now showing results. Our reserves are recovering, our financial risks are reducing, and our organization is becoming stronger and more resilient. This means we are one step closer to stabilizing and getting away from the extreme ups and downs of tax increases from zeros to double digits tax increases.”

See Table 2 below to see the impact of Red Deer’s historical tax rate.

The proposed budget reflects the direction set by the previous Council and continues to advance the recommendations outlined in The City’s Financial Roadmap. Significant rigour was brought to this year’s budget planning process, along with a new way of organizing and evaluating new budget requests to align with Council’s 2025 priorities and the Red Deer 2050 vision, ensuring resources are directed toward long-term value and measurable outcomes.

“Through disciplined financial management, we are taking deliberate steps to balance today’s needs with tomorrow’s opportunities,” said Tricia Hercina, Executive Director of Corporate Performance & Supports. “Budget 2026 invests in the infrastructure, systems, and people that support a resilient and responsive organization. It’s about maintaining services residents depend on every day, while continuing to strengthen our financial position for the future.”

Even with limited new spending, The City continues to face significant economic pressures – from rising operating costs and slowed growth to property tax rates that haven’t kept pace with the true cost of services, a pattern that inevitably leads to larger corrections in future years. With that, the draft budget includes a proposed property tax increase of 7.36 per cent. This is also largely driven by contractual obligations such as the RCMP policing contract, and the personnel provision, which covers wage and benefit adjustments required to retain and support City staff. For every $100,000 of assessed residential value, the proposed increase represents approximately $54.21 per year.

Residents are invited to view the 2026 proposed Budget at reddeer.ca/budget. Questions and feedback for Council’s considering can be sent to budget@reddeer.ca until December 1, 2025.

Quick Facts:

- Property Tax Increase: A proposed 7.36% increase, equating to approximately $54.21 annually per $100,000 of residential assessed value.

- Capital Investment Focus: Prioritization of asset preservation and lifecycle management to maintain reliability and mitigate risk. Strategic use of debt remains within legislative and Council limits.

- Debt position: Projected at $349.9M by year-end 2025, well within both City and MGA thresholds. The MGA limits the amount of debt municipalities can take on to 1.5 times their revenue; our current debt is 51% of that amount. Council further restricts debt to 75% of the MGA limit; The City is current at 68%.

- Reserve health: Operating reserves will continue to be replenished with further planned contribution of approximately $10M toward the target minimum threshold of $25M.

Background Information:

Table 1: Municipal Tax Comparison

Table 2: Tax Rate History

For more information, including our FAQ, please visit, reddeer.ca/Budget.